Investors choose to develop commercial real estate because it is a stable asset. Their money is secured in the building’s value which generally increases over time. It is also sustained by income-producing tenants that cover costs and provide a return on investment. One of the best ways to increase your ROI is to save on costs, which can be achieved through Value Engineering your building project. We will cover this more in the paragraphs below.

Obtaining the funds needed for capital-intensive construction and development can be a challenge. The amount needed for a building project can vary in the millions and sometimes billions, depending on the building size and location. Only a handful of companies, and an even smaller handful of individuals, can come up with such capital on the spot. There are a few ways to get around this hurdle; one is to form a consortium.

Consortiums make it possible for several entities (individuals or corporations) to link up and provide the funding for said construction. The more people there are in the consortium, the more will be splitting the profits. This also means more individuals will have a say in the project’s construction. This can lead to potential disagreements, which is one of the reasons why people and corporations may choose to take out a commercial loan.

Funding is a pretty complex subject, especially when it comes to land development. Below, we break down the subject to make it easy for you to understand. First off, what are commercial real estate loans?

What exactly are commercial loans?

A commercial loan is like a home mortgage, but with a few differences. Business owners who want to purchase an existing building can get a “commercial mortgage”. If they plan to renovate an existing building or construct a new building ground-up, they will need a “commercial construction loan.”

What do banks require for a commercial loan?

The bank or financial institution needs to trust you with their money. An excellent way to prove trust is if you have a proven track record of managing real estate properties. This will give the financial institution peace of mind that their money is in good hands.

The bank needs a guarantee on their loan, which may take many forms. This can include a land title or deeds to other buildings. You will need money or capital for the down payment, along with a good pitch about why they should give you the loan.

First, it must be clear that your project is feasible to construct. A good general contractor, such as March Construction, can determine project feasibility. Banks also want to know that 51% of the building or more will be used for your business. Next, the bank will want to know that your investment has a high appraised value compared to the loan, or Loan-To-Value Ratio. When you make a larger down payment on your commercial building, this strengthens your LTV ratio.

Once these requirements are met, commercial real estate loans are win-win situations for both parties. The bank makes money on interest rates and the borrower obtains enough money to carry out their construction project.

What makes commercial building loans different from residential?

Residential loans/mortgages are more common types of loans. So how exactly do they differ from commercial building loans?

The first and the most striking difference is the amount of money involved. The money needed for commercial building development is much larger than for residential construction.

Additionally, so does the loan-to-value (LTV) ratio. For commercial loans, financial institutions tend to provide between 65 to 80 percent of the value of the project in loans. The rest is to be provided by the owner of the project.

Financial institutions need some security and guarantee on their investment. This guarantee can be provided to developers, general contractors, or corporations looking to build. If the entity does not have a credit rating, then the owners or principles of the entity may be asked to guarantee the said loan. A guarantee is when the principals of a company pledge their assets and agree to repay a debt from personal capital in case the company defaults. If the lender does not need a guarantee, then the loan is known as a non-recourse loan.

Corporations and entities are more likely to need a commercial construction loan than a single individual. Residential loans are more often made to individuals looking to make a smaller investment by building or purchasing a home.

Average Commercial Loan Rates

The interest rate on your loan will depend on several factors: Loan type, payment schedule, and principal amount. A commercial construction loan for a multi-million dollar project can be between 2 and 5 percent. This also depends on market conditions.

Loan Repayment Proecss

The amount of the loan to be paid back is a summation of the principal amount. This is the amount that was initially borrowed, plus the total amount accumulated at the interest rate. The time to pay back the loan is called the amortization period. Commercial loans tend to have a payment period of between five and twenty years.

Commercial loans have an amortization period that is longer than the term of the loan. For example, a corporation may take a loan with a term of seven years, and with an amortization period of 30 years. This means that the corporation would pay the loan over seven years, but the amount paid would be that of a loan that lasted 30 years. After the end of the seven years, the said corporation would make a balloon payment that would pay off the remaining amount.

Loan-to-Value, or LTV Ratio

The LTV ratio is calculated by dividing the amount of the loan needed by the purchase price or the appraisal price, whichever is lesser. For example, if a loan of 900,000 dollars is needed for a construction project that would cost one million dollars, the LTV is 90 percent. Borrowers with a lower ratio tend to qualify for favorable loan rates. On average, banks’ LTVs tend to be between 75 and 80 percent.

Debt-Service Ratio

The annual debt service is the total amount of principal and interest payments made over 12 months.

The property that you are planning to build must be able to sustain its operating costs. It also needs to service the commercial loan taken out without injecting more money. Show the bank your business plan and outline to increase their trust in your project.

Divide your net operating income by the annual debt service and you get your debt-service ratio. The net operating income of the property should be more than the annual debt service. This is one of the factors that qualifies a project as “feasible.”

Late Penalties

Loan repayment is another aspect you will need to take into account. Investors want their money back, and they want it back in time. If you are not able to pay the loan amount due in time, penalties are likely to accrue. There are four main types of penalties.

Prepayment penalty:

The prepayment penalty is the most common type of penalty. It is calculated by multiplying the amount that has not been paid with the established rate that was agreed upon when the loan was being taken.

Interest guarantee:

If the loan is paid off earlier than expected, the lender may still be entitled to an amount of interest that was already specified.

A lockout:

This is when the borrower of the loan is not able to pay off the loan until a specified amount of time has elapsed, say five years.

Defeasance:

This is a substitute for collateral. Instead of paying cash for the loan to the lender, the borrower can exchange new collateral, such as securities and bonds. This reduces the fees, but there are a couple of penalties that are attached when the loan is paid off in such a method.

Loan Optimization

There are many ways through which you can maximize the commercial loan once you have taken it. Loan optimization reduces the amount of interest to be paid. It also ensures that no penalty fees are accrued and that the loan is paid off in a shorter amount of time. This helps you save money.

Fast-Tracking Your Project can Save Money

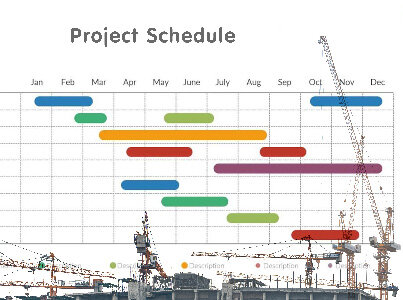

When you optimize your project’s timeline, this saves you money. A long-term project costs more on labor and machinery. It also puts off when you can start making your money back via rent and sales.

While making sure that the least amount of time is spent on the construction of the project, many people will settle for lower quality. This can be a mistake in the long run. Nobody wants to rent out a low-quality space, be it a warehouse, an office, or even a multifamily block. The perfect balance between time and quality optimization needs to be struck. The best way to do this is by getting yourself a good general contractor or construction manager.

General constructors cover all aspects of construction management. A good GC understands that you have a vision for the space that you want to create and is willing to attain your goals. Find a general contractor with good references and testimonials from people who have worked with them in the past.

If your commercial building project is in the New York metropolitan area, March Construction & Consulting is an excellent choice. March Construction is one of ENR’s Top 400 Contractors Nationwide and was nominated for NJBIZ Business of The Year in 2020.

March brings over 30 years of construction industry excellence, working with Triple-A clients across the Northeast. We offer commercial construction and general contracting. This includes design-build, preconstruction, project management, site development, construction consulting and more. March works on a variety of different commercial building types, such has Industrial, Retail, Residential, and Office. We are experienced with fast-track construction projects.

Increase your ROI with Value Engineering

One of the best ways to increase your ROI is to lower your costs. We encourage our clients to use our value engineering services. Value engineering is a systematic method that ensures you do not overpay for your commercial project. This will help you receive the best quality while getting the most savings. Value engineering is even more necessary in today’s market due to considerable increases in the cost of labor and materials.

Here are a few common ways that we can lower the costs of your building project and help increase your ROI:

- Substituting like-materials

- Installing an HVAC system that saves you money on initial installation, or install an automated system designed to save you thousands on operational/utility costs.

- Value engineer your building’s total design and structure to cut costs.

Conclusion

Commercial building construction can be very labor and capital-intensive. It may seem like an arduous task, but hiring a good construction manager and general contractor will make things easier. We can take on the logistics, planning, and management with excellent communication every step of the way. We can also help partner you with a good lender if you need financing.

For your commercial building, you would want the best quality at the cheapest rate. Give us a call today. We can help you bring in your commercial project on time and under budget.